Unveiling the Future of Transactions With RedotPay

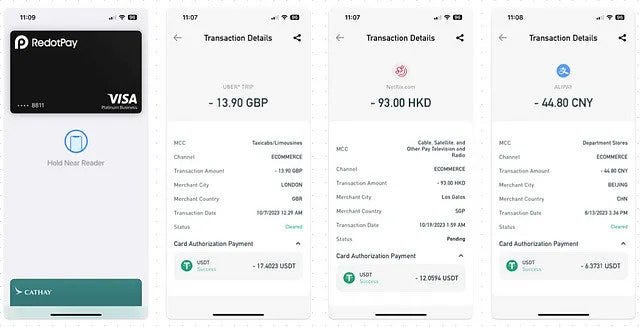

In the rapidly evolving landscape of digital finance, RedotPay, a Hong Kong-based cryptocurrency payment platform, has emerged as a game-changer with the introduction of its encrypted Visa card.

This physical card, now available for global application, signifies a groundbreaking step towards merging the realms of cryptocurrencies and traditional finance.

RedotPay: Pioneering a Visa-Certified Crypto Credit Card

RedotPay stands at the forefront as the first Hong Kong native Visa-certified cryptocurrency credit card project. Headquartered in the bustling Central district of Hong Kong, RedotPay has positioned itself as a trailblazer, not only in the region but on a global scale.

Earlier this year, RedotPay took the digital world by storm with the launch of its virtual card and app. This digital foray seamlessly integrated with popular payment services such as Apple Pay, Google Pay, PayPal, Alipay, and WeChat Pay. Users could effortlessly transact in cryptocurrencies for a myriad of everyday activities, from public transportation and dining to shopping, Uber rides, Netflix subscriptions, and more.

Real-World Impact: RedotPay in Action

1. Global ATM Withdrawals and In-Person Transactions

The introduction of the physical RedotPay card addresses a crucial need for cryptocurrency users — ATM withdrawals in fiat currencies worldwide. RedotPay users with the physical card can now withdraw local currency from any Visa-accepting ATM globally.

Beyond the realm of digital transactions, the card enhances RedotPay’s compatibility in regions where electronic payments are not yet ubiquitous, allowing users to make in-person card swipes or tap payments.

2. Seamless Application Process

The application process for the RedotPay card is a user-friendly experience. Whether opting for the physical or virtual card, users can complete the entire process within the RedotPay app. Identity verification and the deposit of equivalent digital assets for card payments are seamlessly integrated into the app.

Application Steps for Physical Card:

- Complete identity verification and deposit the equivalent digital assets.

- Navigate to the card application page, select the physical card option, and click “Order Card.”

- Fill in billing and shipping addresses, along with a personal signature.

- Complete the payment.

- Receive a successful application notification and await card production and shipment.

- Upon receipt, activate the card following provided instructions.

Application Steps for Virtual Card:

- Complete identity verification and deposit the equivalent digital assets.

- Navigate to the card application page, select the virtual card option, and click “Order Card.”

- Fill in your billing address.

- Complete the payment.

- Wait for a moment, and the virtual card will be successfully activated.

While virtual card applications and activations are swift, the production and shipment of physical cards typically take 5–10 business days.

Safety at the Core: RedotPay’s Robust Security Protocols

Ensuring the safety and legality of user assets is paramount for RedotPay. Operating within Hong Kong’s regulatory framework, RedotPay has forged alliances with authoritative third-party platforms to implement top-notch safety protocols.

1. KYC (Know Your Customer) Protocols

For KYC processes, RedotPay leverages services from Sumsub. KYC is a pivotal step in verifying the identity and background of customers, preventing illegal activities. RedotPay employs over a hundred sanction lists, including those under the United Nations Sanctions Ordinance and the United Nations (Anti-Terrorism Measures) Ordinance.

2. Transaction Monitoring (KYT)

In collaboration with Beosin, RedotPay implements transaction monitoring (KYT) using tools like EagleEye and Trace. This ensures the constant monitoring of financial activities across the platform, fortifying the security of users’ digital assets.

3. Unique Blockchain Address and Asset Separation

To enhance security, RedotPay assigns a unique blockchain address to each user, effectively separating the card from the user’s assets. This safeguard ensures that issues such as the freezing of RedotPay cards don’t impact users’ wallets and assets. Users can freely deposit or withdraw assets from their RedotPay wallet without any restrictions.

4. Secure Asset Storage with Licensed Trust Provider

RedotPay takes an extra step in securing users’ assets by entrusting them to a licensed Trust or Company Service Provider (TCSP) in Hong Kong. This arrangement ensures that RedotPay users are registered as the owners of their digital assets, guaranteeing ownership rights even in scenarios like company bankruptcy.

5. Transparent Fee Structure

RedotPay operates on a transparent fee structure, ensuring that users are aware of any associated costs. As the principle behind RedotPay’s crypto credit card involves users gaining fiat credit limits by depositing digital assets, there are no additional deposit fees or holding periods seen in traditional crypto cards.

Embracing the Future of Finance with RedotPay

As users engage with RedotPay’s products and services, it’s crucial to be aware of jurisdictional limitations. The use of the RedotPay card implies agreement with terms of service, privacy policy, and associated fee schedules. The availability of RedotPay’s offerings is subject to jurisdictional restrictions.

In conclusion, RedotPay’s physical card launch marks a significant stride towards mainstream acceptance of cryptocurrency in daily transactions. By seamlessly integrating with the traditional financial infrastructure, RedotPay is paving the way for a future where crypto and fiat currencies coexist harmoniously.

For more information or to apply for the RedotPay card, visit the official website.